There is a common expression that I often use: never let facts stand in the way of a good argument.

However, with regard to the NBA lockout, true “facts” are difficult to come by.

The issues I’ve had with some recent media articles on the NBA lockout usually fall into three categories:

- Interchanging or confusing operating income (EBITDA) margins and net income margins to serve an argument.

- The lack of understanding regarding amortization and depreciation of assets, and the general assumptions that all non-cash expenses are “accounting tricks”.

- Trying to remove interest payments, taxes and other legitimate cash expenses and/or ignoring the cash flow statement in their analysis.

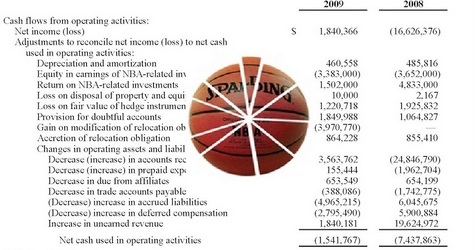

With regard to the “facts”, we have recent financials from the New Orleans Hornets and a previous Deadspin article on New Jersey’s finances from 2003-2006.

It’s much easier to blame the “mega-rich-super-evil” owners because it’s popular and nothing gets your article cheap hits like a riled up NBA fan base. Feed to mob. Everyone wants someone to blame. Choose the easy target.

Never did I think I would have quite so significant issues with how credible media sources like the NY Times, Huffington Post, and respected economists Nate Silver and David Berri present their arguments. Nor did I with local media writer Bruce Arthur, who is usually spot on, but was quite confident in his financial acumen the other day. I attempted to warn him about the flaws in the article, but he felt confident that I wan’t understanding the accounting as well as he did. Nor did he wish to share his secrets at the time.

By no means am I trying to defend the owners’ position. However, without a clear picture of what data should be compared and a proper understanding of accounting, its difficult to have a balanced debate.

The difference between operating margin and net margin is very material

NY Times’ Nate Silver compared the NBA’s operating margin with Fortune 500 net income margins.

I didn’t see this coming. Here is a widely read and quoted article which is in large part based on a flawed analysis. First, and he does disclose this as a caveat, he relies on Forbes’ estimates for the analysis. While I have an issue with using these estimates as a basis of analysis, its not relevant to this very odd statement:

A 5 percent or 7 percent profit is not dissimilar to what other businesses have experienced recently. Fortune 500 companies, for instance, collectively turned a 4.0 percent profit in 2009 and a 6.6 percent profit in 2010 (both figures after taxes). Profit margins in the entertainment industry, in which the N.B.A. should probably be classified, have generally been a bit lower than that.

Unfortunately, he did not provide a source for this data

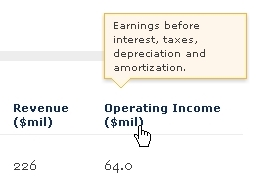

However, the data from Forbes is very clear: it defines “operating profit” as Earnings before Interest, Taxes, Deprecation and Amortization, also commonly know as EBITDA. Which is NOT net profit.

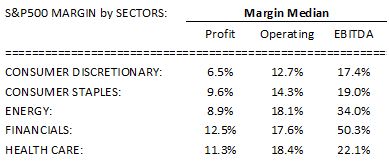

The Fortune 500 EBITDA data was not readily available, but the 5-7% range Mr. Silver relied upon appears to be the range of the Fortune 500’s NET profit. The best EBITDA data (and certainly comparable) available to me is S&P 500 data.

Source: Bloomberg

As you can see, EBITDA margins are much (approximately 3x to 10x!) higher than Mr. Silver reports. He states that the entertainment industry is even lower (yet again, no sources). His range of profit margins could be from the Consumer Discretionary sector which yielded a profit margin of 6.5% in the most recent quarter. The S&P 500 media subsector (see link with further segmented information of the Consumer Discretionary category) reported 26.7% EBITDA margin in the first quarter of this year. Perhaps we should classify NBA franchises as “Consumer Services” instead? Well that segment had a 24.0% EBITDA margin.

Mr. Silver even notes both “figures are after taxes” yet continues to compare them to the Forbes data, where Forbes clearly states that their numbers are before taxes. Mr. Silver also unfortunately relies on the flawed Deadspin article. Bad data, but big hits = profit for NY Times.

I do agree with Mr. Silver’s argument….

If the league expects their figures to be viewed credibly, they should open up their books to journalists, economists and fans.

However, if the NY Times and leading economists endorse the comparison of EBITDA for NBA to net profit of a group, then I would be reluctant to disclose this as well. Notice, he didn’t mention accountants nor finance professionals.

While less relevant to the argument, its also clear that Forbes’ estimates can vary significantly from reality (a caveat Mr. Silver clearly makes).

Amortization and non-cash expenses

Amortization/depreciation is the process of depreciating an asset over a period of time. The amortization itself is a “non-cash” expense (no, not an accounting “trick”). The easiest example to conceptionalize this is a car purchase. Say you purchase a car for $20,000. Your “balance sheet” impact on this transaction would be a reduction in cash (an asset) by $20,000 and an increase in your car asset of $20,000. However, since the value of your car depreciates every year, you would depreciate/amortize it over its lifespan. Thus, for simplicity, you assume the car will be useful for 5 years and depreciate it at $4,000 per year. So is the $4,000 per year expense a “gimmick”? Of course not. Cash went out the door up front and you simply deferred the accounting of the expense over its useful life. We can hopefully agree, that when it comes to “hard” or “tangible” assets that this amortization is legitimate.

However, there are certainly “intangible” amortization items that are often removed to obtain some version of “cash earnings”. Amortization of intangibles is not new and certainly not limited to NBA ownership.

As CBA expert Larry Coon points out as it relates to the amortization of some intangibles:

This doesn’t mean they cooked their books, or that they tried to pull a fast one on the players. It is part of the generally accepted accounting practice to transfer expenses from the acquisition to the profit and loss over a certain time period.

And the very next sentences reads:

However, it’s an argument that doesn’t hold water in a discussion with Hunter and the players association, who would claim that the Nets didn’t really “lose” a combined $106.4 million in those two years, but rather that they lost $7.5 million and $17.2 million, respectively.

Okay, so even if we ignore the amortization of intangibles, the Nets “only” lost $24.7 million over two years?! That’s still quite bad, no? A far cry from big supposed profits.

I’ll also offer the response to the Deadspin article from Carol Sawdye, the NBA’s Chief Financial Officer:

We did not include purchase price amortization in the financial data that we gave to the players and all of the net loss numbers we have used both with the players union and disclosed publicly do not include purchase price amortization. Put simply, none of the Nets’ losses or the league losses previously disclosed are related to team purchase accounting. [emphasis added]

Since their are plenty of lawyers involved on both sides watching every word – I’ll take the CFO’s claim at face value. Although NBA executive director Billy Hunter did say:

If you decide you don’t count interest and depreciation, you already lop off 250 [million] of the 370 million dollars.

I have three potential problems with the statement:

- It’s not clear what depreciation he’s removing – if its related to capital expenditures, then removing it is aggressive [it’s a legit expense];

- Interest should not be removed; debt is a common and often important part of the capital structure of any company and interest is a cash outlay; and

- Even with these debatable exclusions, teams would still be losing $120 million in aggregate.

If you invested $400 million, would you at least hope to be able cover your interest costs on your debt? How about the $3 million in improved facilities for your players that is being depreciated? I’d hope that’s viewed as a legitimate expense. And we haven’t even come to the point of discussing why an investor shouldn’t expect a small positive return on investment.

A not so simple solution

David Berri, of Wins Produced fame, penned an interesting piece for Huffington Post “Do the Players — and Cities — Really Need NBA Owners?” He claims “a simple solution is for (cities and players) to come together and form a new basketball league…” Simple?! Um, far from.

An interesting idea, but I would not describe it as a “simple” process. Have you ever sat in a municipal council session?! Can you imagine them trying to run a sports team? Oh, you may also want to call the City of Glendale and ask them how much council enjoyed voting on this? I’m not sure where it ranks exactly but “Managing a Sports Franchise Without Losing Money” is not likely to be anywhere near the top of the list of “Things Municipal Governments Do Well.” Finally, as an economist, I’m a bit disappointed he doesn’t outline the current challenges in the municipal debt markets. Higher yields mean higher debt service costs. He also argues a dozen or so cities with over 1 million people that could potentially host a team, failing to consider their municipal debt challenges, and that many of these arenas would not have the proper (or enough) luxury boxes and local business support needed in this day and age to support expenses.

Here are the comments Berri quoted from Joe Lacob, the new-ish owner of the Golden State Warriors:

Look, sports franchises appreciate 10% a year on average over three decades, the last three decades. There’s no reason to think this won’t appreciate in value. So that is the least of my worries. We will make money on this team in appreciation of value.

While we could debate efficient markets all day, there are many examples where fundamental value and prices diverge for a period of time. The U.S. housing market (traditionally viewed as stable) was the subject of countless quotes very similar to Mr. Lacob’s. Since U.S. homeowners can write off mortgage interest on the tax returns (“Accounting shenanigans! Borrowing money to pay more than you have and getting a tax bonus? Bidding up assets? Those darn owners.” Maybe Billy Hunter should also tell home owners their interest isn’t real.) Housing prices in seven metropolitan areas appreciated by more than 80% in five years only to decline 50%+ in several cases in future years.

As the housing bubble grew, Federal Reserve chairman Alan Greenspan said something worth noting:

…this vast increase in the market value of asset claims is in part the indirect result of investors accepting lower compensation for risk. Such an increase in market value is too often viewed by market participants as structural and permanent.

Sounds like that just may apply to NBA franchise asset growth arguments as well. Asset prices eventually find fundamental levels. And in the NBA, some reasonable cash flow is needed to sustain $300 million+ valuations (although scarcity value will reduce ROI “hurdles” vis-a-vis many other investments)

Dr. Berri’s article sources Mr. Silver’s piece as well (he should also recognize the difference between EBITDA margins and net margins, but I digress) and fellow Wins Produced disciple Arturo Galletti, who’s post boldly claims owners are “really and truly making a profit” (how he concludes this without seeing all the financial statements is beyond me). However, we can still dissect the example he (and everyone else) uses abuses. In Mr. Galletti’s first chart, he includes $340 in losses under “NBA Claimed Losses”, but adds back Roster Depreciation Allowance despite the league’s comments that “we do not include purchase price amortization from when a team is sold or under any circumstances in any of our reported losses.”

Beyond this, Mr. Galletti appears to be using a relatively current figure for average franchise values and argues a minimum of 40% of NBA franchises are using the full value of their Roster Depreciation Allowance (this figure may not be 100% of intangible amortization). From his own “Smoking Gun” picture of New Jersey’s financials (which we linked to above), it clearly states in the summary of intangible assets acquired that “franchise asset” is valued at $161.1 million or 44.6% of all intangible assets and “is not amortized as it has been categorized as an indefinite-lived intangible asset.” (emphasis added). [Addendum: I would note, however, that the RDA has changed such that his example of recent transactions (like the Golden State Warriors sale) is correct. Its the methodology and assumptions I take issue with]

While a more minor point, his assumptions would also have to assume every single company was profitable without this amortization expense – as a tax shield is useless if the franchise is still losing money even when adding back this amortization (as was the case in the New Orleans Hornets’ financials – you’ll also notice if you’re sharp that TOTAL depreciation AND amortization for the Hornets was under $0.5 million for both years. Interesting.)

One method of helping cut through the clutter is to look to the cash flow statement and calculate free cash flow. This method removes ALL amortization and deprecation and subtracts capital expenditures. For those playing at home, forward to page 7 in the New Jersey Nets financials presented by Deadspin. The New Jersey Nets had negative free cash flow of 67.6 million over the two years presented in the statements. Over 65 million dollars of cash out the door in two years. Cash.

A final note: I began this post shortly after these articles appeared. To the NY Times’ and Deadspin’s credit, they have since updated their sites and at least partially admitted some of their claims were erroneous and/or challenged. You can read Nate Silver’s follow on piece here, however he does not correct his comparison analysis of net margin to EBITDA margin. Deadspin simply edited its original post admitting: “Portions of the analysis below are wrong”. They’ve since changed the title of the post from “Exclusive: How And Why An NBA Team Makes A 7 Million Profit Look Like A 28 Million Loss” to “How An NBA Team Makes Money Disappear.” They finally admit: “The example is bad, and I apologize for that.”

I have a view that whether you are part of the mainstream media or a blogger, you should not manipulate data to serve your argument. The posts I have linked to have been widely read and largely accepted (see the comments sections for any of them) as proper analysis. And endorsed by widely followed journalists like our own Bruce Arthur (I asked Mr. Arthur to comment on my previous warning about the Deadspin article and its subsequent admission of its errors, but did not get a response).

I’ll put together a follow up post on potential solutions and what data we’d like to see. The owners’ position has some many issues (e.g. the argument to look at revenue sharing after finalizing a new CBA is very weak – it NEEDS to be addressed at the same time) and the player’s claims could be exaggerated on occasion as well. As often is the case, the truth is somewhere in the middle.

Everyone is entitled to their own opinions, but they are not entitled to their own facts. -Robert Sobel

The truth is out there.

Comment below, email me: tomliston@gmail.com or find me on Twitter.